Startup funding is actually a vital element for business people in Australia trying to change their modern Tips into viable enterprises. With a amount of funding resources obtainable, from federal authorities grants to non-public financial commitment, Australian startups achieve usage of considerable resources that should help them get over monetary limitations and gasoline advancement.

Varieties of Startup Funding in Australia

Governing administration Grants and Applications: The Australian federal government features quite a few grants and incentives specifically for startups. 1 inside the hottest would be the Investigate and Enhancement (R&D) Tax Incentive, which provides tax offsets to firms paying for qualified R&D routines. An additional noteworthy software could possibly be the Business people' Programme, that provides funding and specialist tips to help you startups grow their competitiveness and efficiency.

The brand new Business Incentive Scheme (NEIS) may be the one particular other precious initiative that provides instruction, mentoring, and earnings support to eligible persons starting a complete new business. This is especially great for entrepreneurs who will need foundational aid to establish their ventures on your own.

Undertaking Capital (VC): Enterprise funds is usually a major source of funding for Australian startups, Particularly People in engineering and innovation sectors. VC companies deliver financial assets in substitution for fairness, generally centering on substantial-development possible firms. Noteworthy VC companies in Australia include Blackbird Ventures, Sq. Peg Capital, and Airtree Ventures. These firms typically invest in early-stage startups, supplying not merely money but additionally valuable business enterprise know-how, connections, and mentorship.

Angel Traders: Angel buyers are people that supply early-phase funding to startups, commonly in substitution for fairness. These traders frequently request out substantial-hazard, significant-reward chances which allow it to certainly be a beneficial source of capital for startups which will not even qualify for advancement cash or financial loans. Angel investors in Australia, like Sydney Angels and Melbourne Angels, present mentorship and guidance.

Crowdfunding: Crowdfunding has emerged similar to a popular usually means for startups to boost funds in Australia. Platforms like Pozible, Kickstarter, and Indiegogo permit business owners to pitch their methods to the general public and acquire modest contributions coming from a several backers. This method is very attractive for Artistic, social, or community-driven assignments.

Accelerators and Incubators: Lots of Australian startups make use of accelerator and incubator plans. These packages, for instance Startmate and BlueChilli, offer you funding, mentorship, and assets in return for equity. They can be designed to quickly-monitor the roll-away from startups, delivering intensive support over a brief period of time.

Troubles and Issues

When there are many funding prospects obtainable, competition is fierce. Securing startup funding generally will take a sturdy company approach system, distinct economic projections, in addition to a compelling pitch that demonstrates the viability and scalability while in the notion. Moreover, business owners has to be aware on the conditions connected to each funding supply, together with equity dilution with click here VC or angel investments.

Summary

Startup funding in Australia is diverse, giving combining authorities guidance, private expenditure, and alternative approaches like crowdfunding. With the ideal technique and preparation, business owners can make the most of these methods to gas their business enterprise growth, accelerate innovation, and build a sturdy sector existence. Irrespective of whether it’s by grants, investment decision capital, or personal buyers, Australian startups gain entry to many different selections to turn their ideas into prosperous companies.

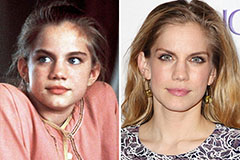

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!